Around May or June last year I finally paid off my student loan. I called up the Student Loans Company, and either made a card payment over the phone, or else made a bank transfer of the amount they instructed me to pay, I don't recall which. And I didn't think any more of it.

4 weeks ago I filled in my self-assessment tax return and it was saying it wanted some money for a student loan repayment. That's strange, because I paid off my student loan ages ago.

So I didn't submit my self-assessment just yet, I wanted to resolve the student loan issue first.

So then I checked on the Student Loans Company website and it was saying I still owed 67p on my student loan! Presumably this is interest that had accrued before I paid off the loan but had not been added to my balance at the point I paid it off. How annoying, surely this is not the first time anyone has called up wanting to repay their loan, they ought to have a process for this.

If they had just taken £1 more off me at the time I paid it off I wouldn't have noticed and it wouldn't matter, but now I have an unwarranted bill from HMRC for thousands of pounds of student loan repayment, to go towards repaying my 67p balance.

So I phoned up the Student Loans Company again, on the same day I discovered the problem about 4 weeks ago. The first person I spoke to didn't seem particularly competent and hung up on me mid-conversation. I called back and got someone better. I impressed upon this person how important it was that I completely pay off the loan and not leave a random penny still owed. I asked if I could pay 68p instead of 67p just to make sure, but they said no and assured me that 67p was the correct amount.

They said it could take 5 working days until the "stop notice" arrives at HMRC (Why? Are they sending it by post?) and after that HMRC will no longer want to take a student-loan repayment.

So I left it for a while.

Now approximately 20 working days have passed, and I loaded up the HMRC web interface and checked my self-assessment again and it is still wanting to take the same amount of money for a student loan repayment.

There is an important but ambiguously-worded question in the self-assessment form:

Did you receive notification from Student Loans Company that repayment of an Income Contingent Student Loan began before 6 April 2025?

I don't recall receiving any such notification, but perhaps I did a long time ago. I think what they're getting at is "Should you be making student loan repayments?", and my answer is "Yes".

Since I have now definitely paid off my student loan I tried changing my answer to "No". Only it won't let me, because another part of my tax return says that I made £200 of student loan repayments via PAYE, and therefore I must have been making student loan repayments.

OK, fine. So I called up HMRC, their automated voice informed me that the recent average wait time is 20 minutes, and it also advised me at one point to "Just hang up".

It asked me what I was calling about, and I explained the situation, and to my surprise and delight it responded something like "I think you're asking about reducing your student loan deduction, is that correct?" - Yes! Good bot! Wow, isn't technology something? This stuff never used to work.

So I say "yes" and it goes into this spiel about reducing the deduction that your employer is taking, which is actually not relevant to my problem, and how you can only do this via the Student Loans Company and not via HMRC, and at the end of its monologue it said "Thanks for calling. Goodbye" and hung up on me!

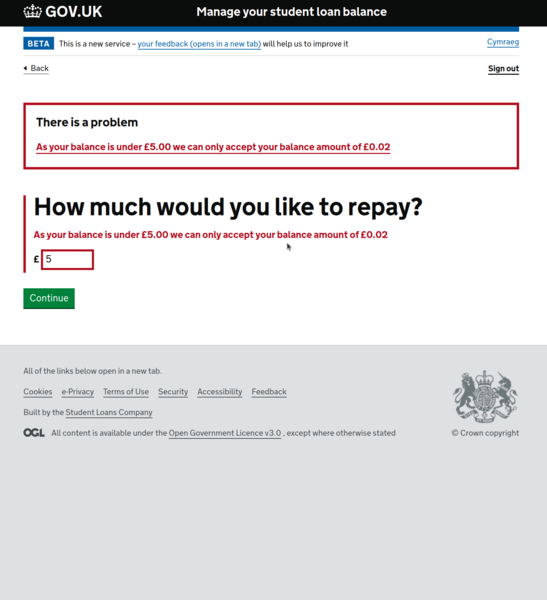

I have just logged in to the Student Loans Company website again and it is showing that I made a 67p payment but I still have a 2p balance! What the fuck?

So now what? Do I just pay the thousands of pounds and hope to get refunded later? Do I persist in trying to engage this Kafkaesque system?

I'm not really sure what the lessons are here. Don't use PAYE? Don't take out a student loan? Don't bother paying off your student loan because it won't reduce your repayments anyway?

I wanted to try making a one-off loan payment of £5, to wait 5 working days to see if the repayment disappears from my tax return, and then never bother chasing up my £4.98 refund. But it won't even let me!

My word. Is it even worth taking a 2p card payment? And would a 2p payment even work or is this just Zeno's loan repayment paradox?